The Sunday News

Bongani Ngwenya

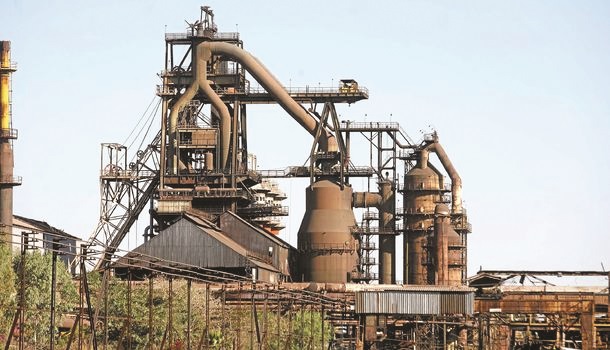

THE intention to adopt the Ziscosteel (Debt Assumption) Act which was signed into law is a noble cause which, however, negates the fact that a forensic audit was not done or at least determining the real reasons why the largest steel maker in Sub-Saharan Africa outside of South Africa is its current state.

The Government has good intentions to try and revive Ziscosteel but swallowing the whole debt of US$494,8 million hook, line and sinker might not be the best way to go about it. This article will show the role that parastatals play in an economy like Zimbabwe’s, the origins and performance of Zisco and its pivotal role in the economy and it will go on and show the implications of the Zisco Debt Assumption Act on the economy.

Role of parastatals in the economy

A key role that parastatals play is to fill in the gaps that typically arise due to various dimensions of market failure. Strategic sectors like electricity, coal, urban water provision and railway transportation are often shunned by the private sector due to the huge financial outlays that are required to start up, run and maintain these often “social” projects. It is with this in mind that State Owned Enterprises (SOEs) were created to solve market failure.

The “social” nature of the SOEs arises in the sense that they are typically basic necessities by their nature, and because of the huge capital outlays, often a delicate line has to be followed in coming up with the appropriate pricing regimes.

Overnight re-alignment of prices to market levels, for instance, may have adverse short to medium-term effects on social welfare, as this may push the essential services out of reach of the majority of members of society.

SOEs play an important role in the Zimbabwean economy, but their poor financial and operational performance has limited their impact. In 1980, Zimbabwe had just 20 SOEs. Despite privatisation efforts undertaken since the 1990s, that number has since risen to 107.

Ziscosteel and the Zimbabwean economy

Iron and steel production on a commercial scale in Zimbabwe started in 1938 when an electric arc furnace of capacity 12 000 tonnes was imported by a few individuals in Bulawayo.

The furnace used steel scrap to produce steel castings and rolled sections. In 1942, the colonial government established the Rhodesian Iron and Steel Commission (Riscom) to take over all iron and steel production in the country and to develop the huge iron and limestone deposits at Redcliff. After Independence in 1980, it was renamed Zimbabwe Iron and Steel Company and by 1990 employed about 5 500 people and indirect employment was around 50 000.

Ziscosteel played an important role as a foreign currency earner as 80 percent of its products were for export and as generator of employment and by 1984 it was the largest foreign exchange earner in the manufacturing sector and the largest single recipient of Government subsidy, a subsidy equivalent to almost two percent of GDP.

Despite a good start and its major contributions to the Zimbabwean economy by 2000, Ziscosteel operated without a fully constituted board and its blast furnaces were no longer functional while its plants and equipment was now obsolete.

In 2006, a National Economic Conduct Inspectorate (NECI) report noted looting of Ziscosteel with the company finances being raided through questionable contracts and a string of payments covering controversial purchases.

In 2006, a parliamentary committee was set up to investigate the existence and findings of the NECI report. Gross abuse of public assets at Ziscosteel was revealed.

Some of the issues included: claiming large allowances from the company after travelling on business that had nothing to do with Zisco, dubious contracts where the bids were rigged, over-pricing purchases, where the excess money would be split between the arranging parties (at the Botswana subsidiaries, only one person handles purchases — contrary to the fundamental principle of segregation of duties), claiming money for management fees and directors’ meetings without justification or following procedure, taking cash for private use, abuse of credit cards and hotel bookings and entertainment allowances.

There were also many questionable payments that Ziscosteel made to South African companies for technical services and to restructure its balance sheet and debt profile.

Because of mismanagement, Ziscosteel also had to surrender its mining concessions to KFW, a German company, after failing to repay a US$17,6 million loan advanced for the construction of its steel plant.

This debt was in addition to numerous others, including those due to the Chinese, National Railways of Zimbabwe (NRZ), power utility, ZESA, among others. By 2010, what was once one of Africa’s largest integrated steelworks was a mass of antiquated machinery and could hardly pay its depleted workforce.

Impact of debt assumption

Much as it is noble to save the workforce which at peak was about 5 500 and resuscitate the Zimbabwean economy using this parastatal as I have previously suggested in articles written before like (<http://www.sundaynews.co.zw/salvaging-nrz-zisco-and-hwange-colliery-from-total-collapse/>) and (<http://www.sundaynews.co.zw/salvaging-nrz-zisco-and-hwange-colliery-from-total-collapse-2/>) the debt assumption will further burden the over taxed Zimbabwean citizen and all this while cushioning the fat cats that looted Ziscosteel dry as shown in the shenanigans above. What should be done is to arrest those implicated in the NECI report of 2006 first then new management with proven track records of performances be employed at the company so that it can become a success again.

As a long list of old habits persist at Ziscosteel, even if new investors are found for the company after cleaning up its balance sheet, the company will still fall into debt in no time and will not deliver on its mandate.For instance, these trends severely weakened the finances of SOEs, as aggregate net losses (before comprehensive income) nearly doubled each year during 2011-2014.

The fragmentation of the public sector will pose considerable fiscal challenges, which are exacerbated by the limited oversight of many public institutions and parastatals. Oversights of extra-budgetary funds in SOEs are largely limited to expenditure auditing. Delays in the publication of audited financial reports prevent timely fiscal assessments of the consolidated public sector.

Given the important role SOEs play in Zimbabwe’s economy, the Government guarantees their debt, and the contingent liabilities generated by SOEs have increasingly strained the public finances.

According to audited reports of SOEs, as of end 2015 SOE debt guarantees accounted for US$2,1 billion of Zimbabwe’s total public and publicly-guaranteed debt. Zimbabwe’s growing public debt burden and large, fragmented public sector continue to threaten fiscal sustainability. Zimbabwe’s total public debt stock has grown rapidly, reaching 70 percent of GDP in 2016.

With limited access to international capital markets, Zimbabwe has increasingly turned to domestic debt financing, largely through the banking system and this has tended to crowd out the private sector from borrowing thereby “killing the goose that lays the golden egg.” Because of the public sector debt, industry has had to compete with Government for the little available domestic capital and this has led to the rise in interest rates and the collapse of most businesses.

The domestic financial sector covered most of the widening fiscal deficit in 2016, and as banks depleted their US dollar reserves, many were unable to accommodate withdrawals.

The main problem with assuming the debt is also that it sets a bad precedence as many other loss making SOEs will also follow suit and present their debts to be assumed yet these losses have accrued because of mismanagement and corruption and they will know they “can get away with murder” as Government will always come to their rescue.

Instead of assuming parastatal debts these monies could have best been put into infrastructure development like power generation and social spending in education and health care provision which are currently underfunded and understaffed and have to rely on foreign donors for their sustenance.

– Butler Tambo is a Policy Analyst who can be reached on [email protected]