The Sunday News

Bruce Ndlovu, Sunday News Reporter

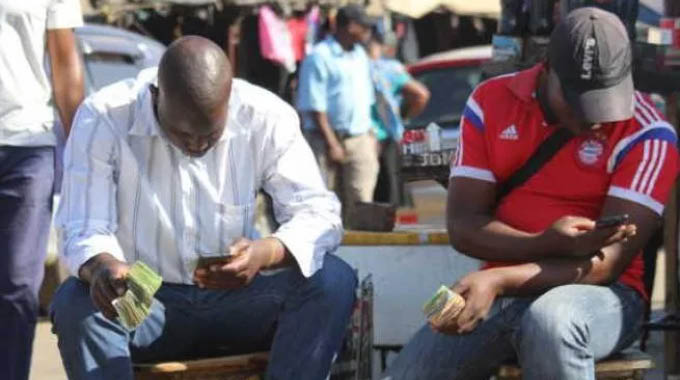

MONEY changers, who were the toast of the town only a few months ago, have been grounded by the recently introduced daily transaction limits and ban on mobile money agent lines, with some abandoning the trade altogether.

Some money changers have instead taken to transferring money on behalf of customers to neighbouring countries, particularly to South Africa, for a small profit. As part of a cocktail of measures to curtail black market activity, the Reserve Bank of Zimbabwe (RBZ) banned mobile money agent lines while setting a $5 000 daily cap on transactions for individuals. One money changer who spoke to Sunday News said the restrictions had put off most of the major money changers, leaving only a few low-level dealers on the street.

“Obviously, there are some young boys that really don’t care about making little money so they’ll come and change money regardless of how little they make. When they reach the daily limit, they just pack up and go. They don’t care if they’ve made just US$5. These are the young boys that had nothing to do before changing money so for them it’s okay. But for most money changers, it is just not worth it anymore,” said the osiphatheleni who spoke to Sunday News on condition of anonymity.

While a few money changers use multiple lines (some registered in other people’s names), the limits still made life difficult for them and curtail their profits. Some had turned to Zipit transactions (bank to bank), but these had a few takers because money changers cannot transact smaller amounts as they used to do with Ecocash.

“You have a few guys that will have three or four lines at their disposal but given the limits, it is very restrictive and almost impossible to make the money some were making before the latest regulations. Perhaps the most that you can make a day is US$5. For now, there’s nothing we can do.

“Most of the people that are still changing money have switched from Ecocash to Zipit. However, this is different from Ecocash because now most of the guys that change do not want to do it for amounts that are less than US$50. The least they can do is maybe US$30. The problem is that there’s little money to be made from all that because most people during the Ecocash days were changing small accounts that range from US$5 to US$10. Few people will come with US$50 and try to change it at once,” one money changer noted.

With profits from changing money dwindling, other money changers have joined those that transfer money between Zimbabwe and other countries, particularly South Africa. According to one money changer who has joined the trade, the system follows a few principles similar to that used by Osiphatheleni (money changers in the streets).

Under this system, the money changers collect money on behalf of businesspeople that want to move their money between the two countries without using normal banking channels. With borders closed and a lot of people relying on South Africa to restock for their businesses, some money changers have found solace in this booming trade.

“Some of the guys are working for businesspeople or companies that are in South Africa. These are people that are earning rand in South Africa but they want to recoup their money back to Zimbabwe without using banks. So, all you will be doing is taking rand or US dollars from people in Zimbabwe that want to send to their relatives or whoever they’re doing business with in South Africa. Meanwhile, the person who you’re working for sends money to those people in SA,” the money changer said.

By inflating rates on the amount of money they changed, osiphatheleni are making a profit.

“Some profit by manipulating the USD to rand rate. For example, the person sponsoring you will give you rand and say change them at a rate of 17.80 to the US dollar. Instead of doing that you will be changing the money at a rate of 17.40 and that 0.4 percent that you gained is your profit from whatever you changed. But others work through a percentage system whereby, for example, they will take R10 000 from their boss and earn five percent per transaction. So, when they’ve changed the whole R10 000 they would have made R500. In whatever you do, you don’t touch your boss’s money but make your profit on the side,” the money changer said.

With black market activity curtailed, banker and financial analyst Mr George Nhepera said it was now evident that measures by authorities were justified.

“You will notice that the twin roles of monetary authorities in all countries in the world, whether developing or developed nations, is to make sure there is price stability and stable exchange rate system. This is what we have managed to achieve during the past few weeks and is a very commendable effort and achievement by the Central Bank and Government. For a very long time, none of us knew the source of instability, but now it has been found and sorted out. It was unregulated mobile money platform which in my view is now under the strict rules, regulation and limits,” he said.

Mr Nhepera said price and currency stability would lead to a revival of key sectors of the country’s economy.

“The short- and long-term benefit of the stability we have achieved is now the renewed focus on investment attraction to our country, revival of production and productivity in key economic sectors such as mining, agriculture, manufacturing and tourism. These sectors could not grow in an unstable macro-economic environment, we have experienced for the past 18 months. As these economic sectors grow, so will be good jobs and better life for everyone, including spill over support of social services delivery such as provision of clean water, quality education and affordable health services,” he said.

While some are crying foul at the cash withdrawal limits from banks, Mr Nhepera said these could only lead to a revitalisation of the country’s banking sector.

“In my view the limits especially on the mobile money platform shall not negatively affect economic activity, especially when individuals and corporate are being given the option to transact huge volume transactions on banking platforms such as RTGS, Zipit, POS and internal transfers. While others think it affects financial inclusion, I, however, hold a different viewpoint. It’s far much better from a policy point of view to work on achieving financial inclusion via the banking system than the mobile money system. This is the common trend in all developed countries including our close neighbours such as South Africa and Botswana. Let’s have all people open banking accounts including our rural people so that we fully restore both prices and exchange rate stability,” he said.