The Sunday News

Roberta Katunga, Senior Business Reporter

BUSINESSES that refuse to accept bond notes or engage in any unprofessional conduct are likely to have their licences withdrawn as this is unlawful, the Confederation of Zimbabwe Retailers said amid revelations that about 60 complaints have been recorded so far.

According to CZR president Mr Denford Mutashu, the association has implemented a competent system to monitor retailers across the country to ensure that the new bond notes that were introduced into the market last week are not rejected.

“We have officers on the ground who are monitoring how retailers conduct business in relation to the bond notes. We have so far dealt with about 60 complaints from consumers relating to shops that were rejecting the notes and those that have increased prices of goods.

‘‘As an association, we are working closely with the Reserve Bank of Zimbabwe to ensure that unscrupulous businesspeople are dealt with according to the law which also entails withdrawal of operating licences,” said Mr Mutashu.

He said despite a few retailers refusing to accept the new notes, acceptance rate was satisfactory.

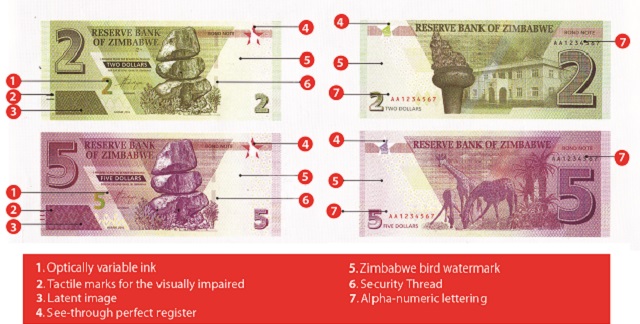

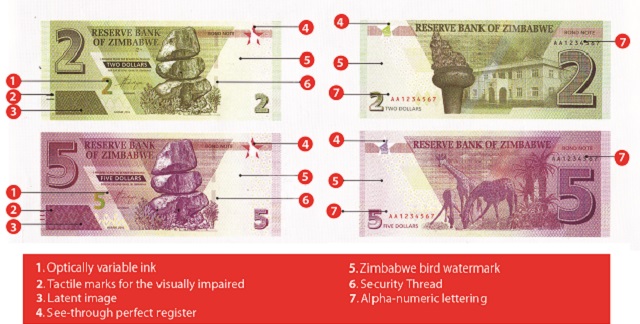

Mr Mutashu said the CZR would be conducting a nationwide campaign meant to educate retailers in the underlying areas on the features of the bond notes as well as breakdown information on the notes.

“In the urban areas, we are sure that a lot has been done to educate businesses on the new notes hence we have to take this campaign to the rural retailers so that they are not duped by fraudsters with fake notes.

‘‘As businesses, we support Government initiatives that are meant to help industry reboot,” he said.

He said the association was also educating consumers not to trade in the parallel market as retailers were accepting bond notes on a 1:1 with the US dollar.

He said one issue that has been raised is that the $50 a day limit was quite low and urged the central bank to increase the daily withdrawals as people were tired of spending a lot of time in queues at banks.

In a separate interview Confederation of Zimbabwe Industries president Mr Busisa Moyo said the bond notes were likely to assist in facilitating change in shops and supporting internal trade in general as people were spending time in queues and unable to access cash.

“Increased access to money could lead to increased sales and this will benefit the manufacturing sector through higher demand for products. It increases the mediums of exchange available and makes the environment more liquid,” said Mr Moyo.

He however said the amounts received in bond notes were still negligible and that not all price increases could be linked to the introduction of bond notes but the fact that the business environment was being viewed as uncertain and the unnecessary panic in the market.

“It must be noted that most manufacturers are paid in RTGS in most instances. Retailers and wholesalers take in the bulk of the cash from the public.

‘‘We cannot link all the price increases to the introduction of bond notes but the business environment is being viewed as uncertain and there is unnecessary panic in the market. This will stabilise if the banking sector creates the necessary confidence by exchanging bonds at the rate communicated by RBZ of 1:1 and Government sticking to the framework announced by the Governor,” he said adding that as long that holds, things will normalise and settle down.

In a survey around the city on the acceptance of bond notes, most businesses confirmed that they were accepting all legal currency in the country including the bond notes saying that they are legal tender.

One major business in the Belmont area said they were even offering customers a 10 percent discount for cash sales.

“We are offering our customers a 10 percent discount on goods paid for in cash, it does not matter whether the cash comes in the form of US dollars or bond notes, to us it is all legal tender,” said a manager who spoke on condition of anonymity.